[ad_1]

David Smith, Americas Head of Occupier Analysis, Cushman & Wakefield, emphasizes the significance of planning prematurely. Picture courtesy of Cushman & Wakefield

Though the reshoring and nearshoring of producing are surging within the U.S., a big impediment to those traits is on the actual property facet, in accordance with a brand new report from Cushman & Wakefield.

Noting that “the composition of actual property might want to change,” the report explains that solely 80 million sq. ft of producing area is at present underneath development on this nation. And of that, half shall be owner-occupied and an additional one-quarter is non–owner-occupied build-to-suit.

Cushman & Wakefield due to this fact predicts that “tight leasing market situations shall be a difficulty for occupiers who haven’t already secured their amenities.”

One other limiting issue is electrical energy, an important want for manufacturing. The report factors out that “many greenfield land websites lack adequate energy to host the manufacturing websites wanted,” additional complicating improvement website choice.

READ ALSO: Prime Markets for Industrial Deliveries in H1

Manufacturing job bulletins in 2022 that have been associated to reshoring and international direct funding topped 360,000, which the report describes as “a record-breaking 53 p.c improve from 2021.”

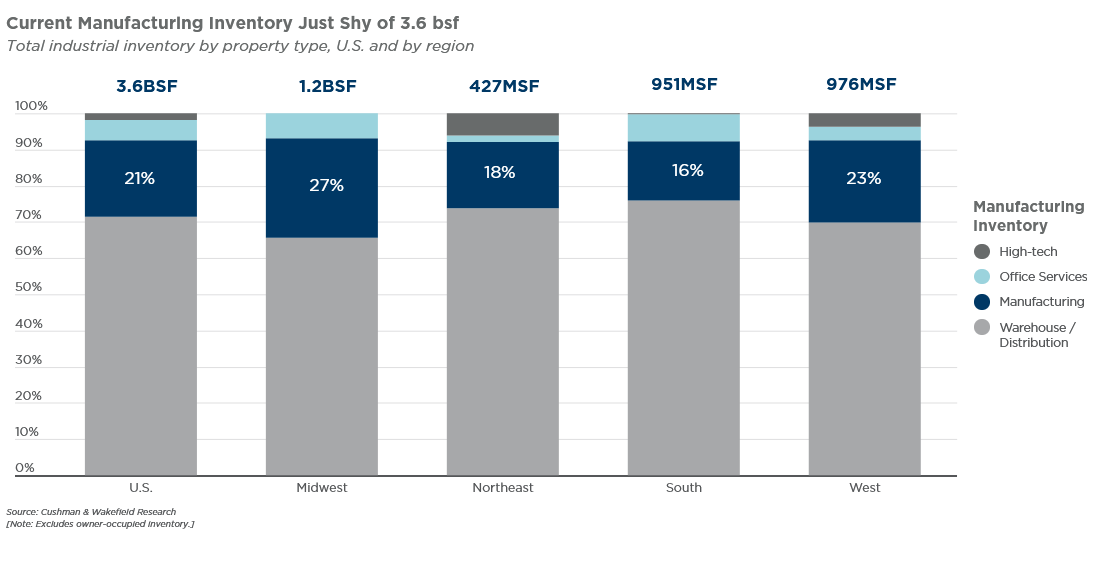

Industrial stock by property kind (excluding owner-occupied stock). Chart courtesy of Cushman & Wakefield

Investments in manufacturing and clear power of $470 billion by non-public corporations since 2020, plus an additional $220 billion by the federal authorities over the identical interval, have helped to drive “manufacturing employment to 13 million as of midyear 2023, its highest degree since 2008,” Cushman & Wakefield states.

Regional shifts, too

On an absolute foundation, manufacturing job demand is strongest in California and Texas, at 24,000 and 17,000 distinctive postings, respectively. The Midwest has essentially the most job postings, at 66,000, a powerful improve of 28 p.c year-over-year, lagging solely the Southeast, at 31 p.c.

The report attributes the continuing shift of producing from the perennially robust Midwest to the Solar Belt to “the robust development in auto-related manufacturing; the 50 metro areas with the very best focus of employment in auto-related manufacturing are all positioned in both Southern or Midwest states.”

As reshoring and nearshoring traits steadily take maintain, “it is going to be vital to contemplate the state of producing actual property,” David Smith, Head of Americas Insights for Cushman & Wakefield, stated in a ready assertion. He added that working strategically on location, understanding labor wants and the price of operations and supplies shall be extra vital than ever, and the planning ought to begin now.

[ad_2]

Source link